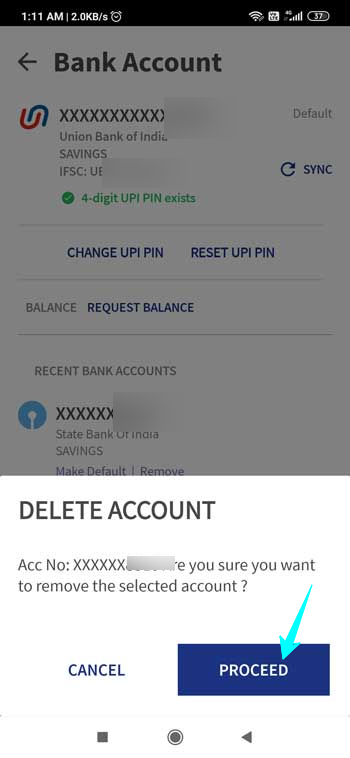

Primary Bank Account For Upi Id Cannot Be Deleted

It’s quite simple, all you need to do is go for a recharge and reach at the checkout (payment) page. And here you will find the option to remove your card from Paytm. Remove Card from Paytm. That’s it, as soon as you will click on this Remove Card.

@idbi, enter your email id and set your login Passcode (4 to 6 digits only).Accept 'Terms and Conditions' and press 'Next'. Select a security question and answer it. Remember the answer to the selected question since you will be prompted to answer this question at the time of generation of forgotten Passcode.- Keep in mind that default or primary bank account on PhonePe is the bank account associated with your BHIM UPI ID. You can easily check your primary/default bank account on PhonePe, tap on My Money Bank Accounts under the Payment methods section. Your primary bank account will have a green tick mark next to it.

- Delete Paytm UPI Account. Login to Paytm application and tap on UPI section. Next screen you can see your UPI account (Linked bank account and UPI ID). Simply tap on three vertical dots on the top (right side) as you can see below screenshot. You can see now “Deregister UPI.

What is a Virtual Payment Address (VPA)?

'Virtual Payment Address' is a unique identifier or Alias (for example 'myname@idbi') that is mapped to an individual account. Thus VPA acts as a payment identifier for sending and collecting money between any two parties without knowing the recipient's name, bank account number and IFSC code.

UPI services of IDBI Bank, offers its customers the provision to create and use multiple Virtual Payment Addresses for linking different bank accounts as well as for making and receiving payments.

How can I generate a VPA?

Download 'PayWiz' APP andgenerate a default VPA at the time of registering yourself. Press 'Payment Address' on the home screen to View, Manage or Create additional VPAs. Here, you can select a particular VPA and then link bank accounts that you have added. For a chosen VPA, you can also assign contacts or manage transaction limits. Note: A default VPA cannot be deleted as it uniquely identifies you at the time of registration. Subsequent created VPAs can always be deleted.

How do I add bank accounts in 'PayWiz'?

- a. Please ensure that the mobile number registered with PayWiz is the same as the mobile number registered with the bank whose account you wish to Add.

- b. Once registered, navigate to 'Bank accounts' and press icon ' + Add Account '.

- c. On the next screen, search for and choose the bank in which you hold an account.

- d. The next page would list all the eligible bank accounts held with the chosen bank and linked to the same mobile number

- e. Choose the account you would like to Add. You will be prompted to create a UPI PIN (six digit).If you already have a UPI PIN for that particular account you have linked, choose the option 'No' when asked to 'GenerateUPI PIN' for chosen account.

- f. Alternatively, choose the option 'Yes' when asked to 'Generate UPI PIN'. Enter your Debit Card details as directed on the next screen. You should receive an OTP from your bank at this point. Enter the OTP as well.

- g. Create your UPI PIN for this account (6 digit). This UPI PIN will be used in the future for every transaction that you make on this account. Ensure you don't reveal this UPI PIN to anyone else.

- h. On successfully completing above steps, your account will be added to the PayWiz Application.

How do I link my bank accounts in 'PayWiz'?

Once added, you can link these bank accounts to a VPA.Press 'Payment Address' on home screen. Select a VPA block. Navigate to screen where you see all the bank accounts that you have added, select a desired bank account for Collect and Pay and press 'Save' .

Remember to Link your default VPA created by you at the time of Registration to a desired account before you begin a transaction using Default VPA.

Can I link more than one account to a single VPA?

Yes, you can. Choose your existing VPA while linking your second bank account. If you linkmore than one account to a VPA, you can set a default account to 'Send' and default account to 'Collect' money.

I intend to add multiple accounts from other banks in PayWiz. Do I need a separate VPA for each of these accounts?

Not required. PayWiz provides you flexibility in choosing accounts at the time of makingpayments or sending collection request.

Though you can assign a separate VPA for each account, please ensure that you appropriately link which account you would like to use as the collect account to receive funds (Credit) and which account you would like to use as the pay account to make payments (Debit).

What are contacts? How do I add them?

'Contacts' is nothing but a the list of beneficiaries.You can add a contact by navigating to menu 'Contacts' on the Home screen of PayWiz and pressing icon 'Add Contact +' . You can maintain the list of contacts both as beneficiary's VPA Or Account number & IFSC code.

You can initiate payment to a selected beneficiary directly from the contacts list or you can send 'collect request' to selected contact from whom you wish to receive money.

How can I transfer money using a VPA?

- a. Login into the 'PayWiz' application.

- b. Pressicon 'Make Payment'.

- c. If you have multiple accounts/virtual payment addresses, you can choose the VPA you would like to debit. The Payment Account linked to select VPA will automatically populate.

- d. Choose the contact type to which you want to pay and select the Name of Contact from the drop down list.

- e. Fill out the details on the screen amount and remarks. Press on 'Next' .

- f. Please review the next screen carefully,if you wish to change the account from which the payment is to be made.

- g. Enter UPI PIN of the selected Bank account and press 'Submit' .

How can I receive money using a VPA?

- a. Login to 'PayWiz'and Press icon 'Request Money'

- b. Select from the list of Contacts, the VPAof the person you would like to collect from. Enter amount and remarks. If you have multiple accounts / virtual payment addresses, you can choose the VPA you would like to credit. You can also choose if you would like to receive the money immediately or in the next 7 days.

- c. Click on 'Confirm' to finish the request. When the person you have requested money from accepts and approves the collect request, money will be credited into your account and you will be notified through an SMS.

How do I respond to a collect request that has been sent to me by another person?

- a. You will receive a notification stating that you have a Collect request pending for action.

- b. To take action on Collect request sent to you, login to 'PayWiz'and Press 'Authorize Request' on home screen

- c. Select 'Next' on the desired Collect Request.

- d. Please review the next screen carefully to ensure you recognize the person or merchant who has initiated the collect request on you. You can choose to change the default account of your VPA from which the payment needs to be made.

- e. Chose a Bank account that you wish to pay from and press 'Authorize' . Enter UPI PIN of the selected Bank Account.

- f. Upon submission of these details and authorization, funds will be transferred instantly to the beneficiary.

- g. If you wish to 'Decline' the transaction, choose appropriate action in step'd' mentioned above.

What is QR code and how do I use it?

Quick Response (QR) code is a square block consisting of patterns which contain information that you want to send in a confidential / safe manner.

In PayWiz you can generate a QR code for both your VPA only Or for the VPA and Amount combined together. Such a QR code can be scanned by Payer from their PayWiz App for sending money to you.

To generate a QR code, navigate to 'Other Services' and Press 'Generate QR' . Select VPA and Amount (if required) and press 'Generate' . The QR Code thus generated can be either downloaded or shared to your contacts via multiple mediums like Whatsapp etc.

What is Scan and Pay?

If you wish to make a close proximity payment (across counter) to merchants e.g. a local General store, you can simply scan the QR code generated by merchant from his/her 'PayWiz' App. To finish making a payment to merchant, navigate to 'Make Payment' on the home screen of your PayWiz App. Select 'Scan and Pay' option, scan the QR code shown to you, choose the account you want to pay from and enter UPI PIN of the selected account.

How can I view my transaction status?

You can check your transaction status in menu 'Transaction history' on the Home Screen of PayWiz. You can either filter the search criteria or check the entire list of transactions that you have undertaken.If I have more than one account linked to a VPA, how do I select the account from which I want to send money to a beneficiary?

When you initiate a transaction, choose the VPA that you would like to transfer funds from. On he next screen, you will be given a confirmation page that lists the account that will be debited. On this page, you will also be given an option to change debit account. Choose this option and select the account that you would like to be debited.What details do I need to either send money or request money?

You can send money to other person on his / her VPA or through the Account number & IFSC.

Is there any transactions limit for sending or requesting money using UPI?

The transaction limits are subject to NPCI guidelines issued to UPI participating Banks.Currently, the per-transaction cap is INR 100,000. Using PayWiz you can configure Individual VPA limits.

Are there any charges for transactions done using UPI?

Currently there are no charges for transactions done through UPI.

How safe is PayWiz, if my mobile phone is lost?

UPI is designed to adhere to the two-factor guidelines of RBI. If you lose your SIM card / mobile, the other person would still need to know your UPI PIN and / or the login Passcode of PayWiz to transact from accounts. If your mobile handset is lost call IDBI Bank Customer Care to block your PayWiz application.

What are the timings for UPI transactions?

UPI services are available 24 hours of the day, all days of the week, throughout the year including all public holidays.

If the transaction is not completed will I get my money back? When?

Yes. In case, your account is debited and beneficiary account is not credited, the reversal should happen instantly. If this reversal has not happened, then you can navigate to 'Raise Dispute' under 'Other Services' in PayWiz and raise a dispute. Alternately, you can call our Toll-free customer care number 18002001947 to seek help.How long does it take for the money to get credited into the beneficiary account?

For successful transactions, funds get credited into the beneficiary's account instantaneouslyWhen sending money, how do I come to know that my account is debited and the money has been credited in the beneficiary's account?

You will get an amount debited SMS notification on your registered cell phone on successful completion of the transaction.If I have any issue with UPI transactions, how can I raise a complaint?

You have the option to either call the bank's toll-free number or raise a complaint within the mobile application itself. You can navigate to 'Raise Dispute' under 'Other Services' in PayWiz and choose a transaction to raise a dispute. Alternately, you can call our Toll free customer care number 18002001947 to seek help.

When can the beneficiary use the funds received through UPI?

The beneficiary can use the funds immediately on receipt of credit into the account.Can I transfer money abroad using UPI?

No.Can I Add and link my NRE / NRO Accounts in PayWiz?

Currently, as per NPCI guidelines you will not be able to Add and link NRE / NRO Accountsunder UPI.What do I do if I forget login passcode?

Press 'forgot Passcode' on your login screen. Answer the Security question set by you at the time of registration. You will be emailed a 'Temporary Passcode' in a password protected file on your registered email id that you provided at the time of registration. To open the file containing the 'Temporary Passcode' , enter your registered mobile number prefixed with 91.You need to now login using the Temporary Passcode. Set a new Login Passcode and continue using PayWiz.

What do I do if I forget the UPI PIN?

You can regenerate the UPI PIN for bank accounts that you have added in PayWiz. Navigate to 'Other Services' on Home Screen of PayWiz. Press 'Generate/Forgot UPI PIN' and select the Bank account for which you want to regenerate the UPI PIN. Enter the Debit Card details. You will receive an OTP from the bank whose account you have selected. Enter the OTP and Set , a new UPI PIN, press 'SUBMIT' .How do I Deregister from PayWiz?

Navigate to Update profile on home screen of PayWiz. Enter your login passcode to open your profile. Press 'Deregister' and then press 'Update' .

Please note that once De-Registered all your saved data, Transaction History, VPA and Contact Details will get deleted.

Can Upi Id Be Deleted

How do I change login Passcode or registered Email id?

Navigate to 'Update profile' on home screen of PayWiz. Enter your login passcode to open your profile. Press 'Change Passcode' , enter new Login Passcode or enter new email id and press 'Update' .

What do I do if I change the device or Mobile Number?

If you have changed the registered mobile number or device, please ensure to deregister from the PayWiz application installed on the existing device and Register yourself afresh for PayWiz on the new device or with new mobile number as the case may be.Primary Bank Account For Upi Id Cannot Be Deleted Account

Primary Bank Account For Upi Id Cannot Be Deleted Password

Once De-Registered all your saved data, Transaction History, VPA and Contact Details will get deleted.Primary Bank Account For Upi Id Cannot Be Deleted Conversations

- By participating in this offer, you agree to be legally bound by and abide by these terms & conditions. You confirm and acknowledge that you have read, understood and agreed to conform to these terms and conditions. If you do not agree to these terms & conditions, please do not participate in this offer.

- This offer is sponsored, organized and administered by One97 Communications Ltd, a company having its registered office at 1st Floor , Devika Tower, Nehru Place, New Delhi - 110019 and corporate office at B-121, Sector 5, Noida, UP 201301 One97 (hereinafter referred to as “One97” / “One97”).

- To participate in this offer, you should (i) have Paytm account/ wallet holder in India (ii) be of or above 18 years of age (iii) must be a resident of India;

- You acknowledge and agree that all copyright and trademarks and all other intellectual property rights in the SMS content, Website, WAP/App portal, and all material or content related to the offer shall remain, at all times, owned by One97 and/or their respective owners. All material and content contained in this WAP/App portal/Website is made available for your personal and non-commercial use only.

- Subject to any applicable law all warranties of any kind whatsoever, whether express or implied, are hereby expressly disclaimed by One97.

- In all matters relating the Cashback offer, the decision of One97 Communications Limited shall be final and binding in all respects

- We reserve the right to modify/change / withdraw all or any of the terms applicable to the Cashback offer, without assigning any reasons or without any prior intimation whatsoever.

- We reserve the right to disqualify any user from the benefit of the Cashback offer if any fraudulent activity is identified as being carried out for purpose of availing the benefits under the Cashback offer or by using Paytm website

- In no event, the entire liability of One97 Communications Limited for any dispute arising in connection with the Cashback offer shall exceed the cashback amount that the user is entitled to under the said offer.

- One97 Communications Limited in no event shall be liable for any incidental, consequential and financial losses/damages in any event whatsoever. You shall indemnify and keep indemnified One97 and their officers, directors, employees, customers, affiliates and agents harmless from and against any and all claims, losses, suits, proceedings, action, liabilities, damages, expenses and costs (including attorney’s fees and court costs) which One97 may incur, pay or become responsible for as a result of breach or alleged breach of your representations or obligations under these Terms and Conditions hereunder, any failure by you to comply with applicable law and any third party claim in respect of misuse of any information of a third party

- One97 Communications Limited shall not be liable for (i) any claims or grievances’/ defects/deficiencies solely attributable to the online partner’s to whom the payment is made/to be made (ii) any claims arising due to Force Majeure events or situations beyond its reasonable control.

- Tax liability, if any, will be borne by user

- This offer is being made purely on a “best effort” basis. Users are not bound in any manner to participate in this offer and any such participation is purely voluntary.

- Other Terms & Conditions and paytm policies apply.

- All issues / queries / complaints / grievances relating to the offer, if any, shall be addressed to customer support on- customer service (plz give address/ phone number/email id for complaints)

- All disputes shall be governed by laws of India and shall be subject to exclusive jurisdiction of the courts at Delhi